Hello everyone, here we have created https://florafox.com/ru/kaliningrad-53 for you. It was very long and hard to realize what we had in mind, but we did it. Now you can come in and try everything we offer. Our product is literally what you need. Be sure to stop by here and you'll find what you've been looking for for a long time. We will try to make everything as detailed as possible and to paint all the nuances.

Top page:

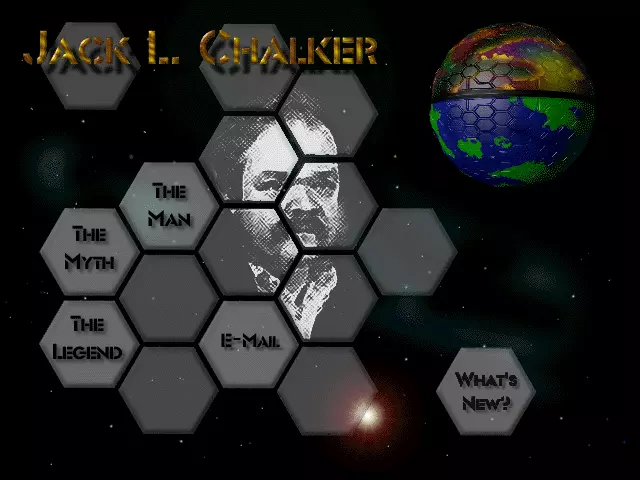

news | jlc-bib | index640l | jlc-home | links | cdrom1l | Top | Steve_97l | m | kidsl | news 200507 | news 200005 | news 200009 | news 200001 | news 200407 | news 200403 | terrorists | news 200106 | news 200102 | news 199904 | news 200502 | news 199908 | news | news 200602 | jackwhol | news 200006 | news 200201 | news 200511 | news 200503 | news 200101 | news 200505 | news 200003 | news 200509 | news 200412 | Midnight Baenl | news 200011 | news 200512 | news 200108 | news 200104 | cons 2001